In Washington, D.C., where historic charm, high prices, and hidden costs collide, not all real estate is created equal. You might think owning a home in the nation’s capital guarantees financial security. However, owning the wrong one can quietly sabotage your credit and drain your resources.

Whether it’s an inherited property that’s too costly to maintain, a fixer-upper that’s become a financial sinkhole, or a primary residence that’s lost value and gained debt, the wrong home can trap you in a cycle of late payments, mounting interest, and damaged credit. A hit to your credit makes it even harder to escape.

If you feel your home is more of a burden than an asset, this blog is for you. Let’s unpack how the wrong house in the District can hurt your credit, and what you can do to protect your financial future.

When a Home Becomes a Liability

What once felt like a wise investment can become a serious financial threat at a certain point. In Washington, D.C., that shift can happen quickly. Property taxes are high, utility costs add up fast, and older homes often come with surprise maintenance issues your budget isn’t ready for. If your income takes a hit or the cost of living rises (as it has throughout the region), a once-manageable mortgage starts quickly falling behind.

When you constantly juggle bills to stay current on your mortgage, your credit score can suffer due to:

- Missed or late mortgage payments

- High credit card debt

- Unpaid taxes or utilities

Each of these issues can push your credit score down. Once that happens, refinancing or taking out a personal loan to stay afloat becomes harder. This financial trap is a dangerous cycle that’s difficult to climb out of.

Property Conditions That Worsen Your Credit Position

Certain home conditions worsen the financial strain. You can easily get stuck when you don’t have the funds for repairs on your Washington, D.C., home. You can’t sell it easily because buyers expect turnkey properties. You can’t refinance it because lenders see too much risk. You might even delay repairs that lead to bigger problems, like water damage or code violations, further devaluing the property and increasing your liabilities.

Older homes in D.C., particularly in neighborhoods like Deanwood, Congress Heights, or Petworth, often carry structural issues or outdated systems that balloon into five-figure renovation needs. When you don’t have the cash to make those fixes, the debt piles up, and your credit takes the hit for every missed payment you make trying to stretch your budget.

What Makes a Property “Wrong” for You?

A home that hurts your credit isn’t bad luck; it’s misalignment. The wrong home is usually one that:

- Costs more to maintain than you can afford

- Doesn’t match your current income or lifestyle

- Has lost value or sits in a stagnant market

- Requires repairs or upgrades you can’t fund

- Can’t be rented out easily to offset costs

- Comes with liens, title problems, or tax burdens

Even modest homes in Washington, D.C., can run above $600,000. Condo fees can top $800 per month. Here, it’s easy to buy more house than you can manage. And once you’re in, getting out can feel like caving to defeat.

The Ripple Effect on Your Financial Future

Credit isn’t just about buying power. It affects your ability to rent, get approved for a new job, secure insurance, or qualify for future financing. If your current home causes consistent credit damage, it’s not just a short-term nuisance; it’s an anchor on your long-term stability.

Let’s say you’re 30 days late on three mortgage payments this year. That alone could drop your credit score by 90 to 100 points. That drop can prevent you from qualifying for a desirable lease. You’ll either face higher interest rates or won’t get approved for a loan to buy a different home. And that’s before accounting for unpaid property taxes, HOA dues, or judgments.

In a high-cost-of-living area like D.C., the financial leeway you lose from poor credit is even more painful.

Why You Shouldn’t Wait for Things to Get Worse

The sooner you act, the more options you preserve. Many homeowners in Washington, D.C., delay the decision to sell out of fear, shame, or confusion. But while you wait, your home may continue hurting your credit and shrinking your financial options. If you’re skipping bills, relying on high-interest credit cards, or struggling to make ends meet month-to-month, the damage isn’t coming; it’s already happening.

A proactive exit strategy might be the healthiest move if you’re underwater on your home or simply can’t keep up.

How a Cash Buyer Can Offer You Relief

One of the fastest and cleanest ways to break free from a credit-damaging property is to sell it as-is to a reputable cash home buyer in Washington, D.C. These buyers are different from traditional home shoppers; they don’t care if the house needs repairs, carries back taxes, or has a crumbling foundation. They assess the property based on its potential, not its polish.

Cash buyers can often:

- Close within 7 to 14 days

- Pay off existing debts and liens at closing

- Help you avoid foreclosure or further credit damage

- Let you skip repairs, agent commissions, and waiting

A cash sale may be the only realistic way to exit a bad housing situation quickly and with some dignity intact in D.C. neighborhoods like Brentwood, Trinidad, or Anacostia, where property conditions vary block by block.

Getting Out Doesn’t Mean Giving Up

Letting go of a home that’s hurting your finances isn’t a failure; it’s a reset. Your credit, stress levels, and peace of mind are worth protecting. It’s time to explore alternatives if your Washington, D.C., home works against those goals.

When you choose a smarter exit, you preserve more of your future. You stop the bleeding before it becomes a crisis. And you put yourself in a stronger position to start fresh, whether that means renting, downsizing, or relocating to a home that fits your life today (not one you imagined years ago).

You’re not trapped. You just need the right strategy.

If your house in Washington, D.C., is costing you more than it’s worth, financially, emotionally, and in terms of your credit, it’s time to consider a solution that puts you back in control. Selling to cash home buyers is the most direct way to stop the damage, recover equity, and move forward.

Video

Infographic

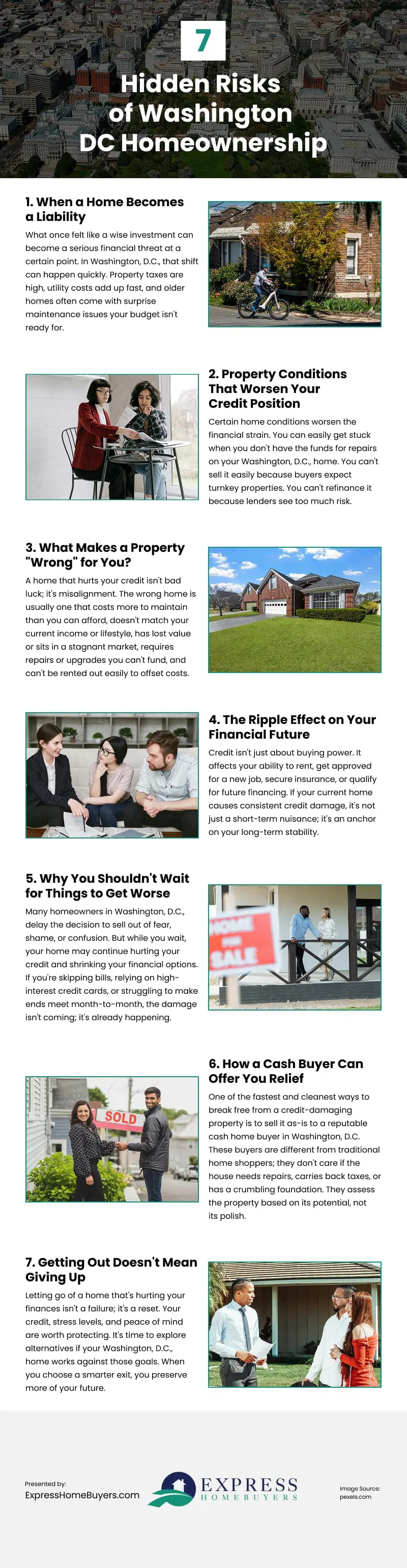

In Washington, D.C., owning the wrong home can strain your finances and hurt your credit. High property taxes, expensive utilities, and unexpected maintenance can make a smart investment a financial burden. This infographic outlines seven hidden risks of homeownership in the area.