It’s a common scenario. You blinked, and you aged another decade. As the years tick by, it has become more challenging to care for and maintain your home to your typical standards. Your home is showing some wear, but it’s hard to fit home improvements into your retirement budget. To top it off, you’ve found that you need some additional help physically. Regardless of whether you are eyeing an independent living community for people over the age of 65, in need of assisted living, or considering in-home health care assistance, those things come with a hefty price tag.

There’s money in your home, but it can be hard to imagine finding a buyer when things have fallen into disrepair. While it’s been a great home for you, it is no longer what today’s buyers consider stylish. Perhaps it even needs extensive work to meet the modern codes required to close a sale.

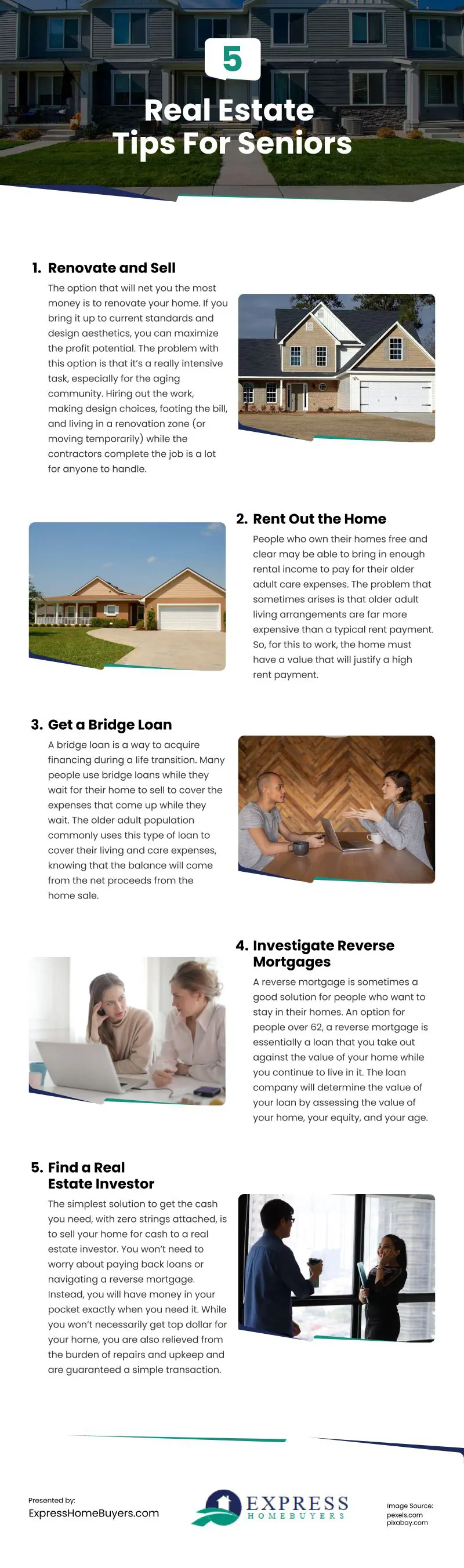

You aren’t alone. Countless people have navigated this exact scenario. The encouraging news is that no matter the condition of your home, its value can be used to pay for your care as you age. There are a handful of common ways older adults will leverage the equity in their homes to ensure they receive the care they deserve. You can enter the next phase of life by working with home buying companies who will buy your house now, or you can explore a handful of other creative options to pay for your care. Here are several of your options:

Renovate and Sell

The option that will net you the most money is to renovate your home. If you bring it up to current standards and design aesthetics, you can maximize the profit potential. The problem with this option is that it’s a really intensive task, especially for the aging community. Hiring out the work, making design choices, footing the bill, and living in a renovation zone (or moving temporarily) while the contractors complete the job is a lot for anyone to handle. While this is an excellent option for a small percentage of the older population, it isn’t feasible for most.

Rent Out the Home

People who own their homes free and clear may be able to bring in enough rental income to pay for their older adult care expenses. The problem that sometimes arises is that older adult living arrangements are far more expensive than a typical rent payment. So, for this to work, the home must have a value that will justify a high rent payment. Renting your home also isn’t the best choice if only one partner needs live-in care while the other wishes to continue living in the house or you have more family members living with you.

Get a Bridge Loan

A bridge loan is a way to acquire financing during a life transition. Many people use bridge loans while they wait for their home to sell to cover the expenses that come up while they wait. The older adult population commonly uses this type of loan to cover their living and care expenses, knowing that the balance will come from the net proceeds from the home sale.

This option is for couples where one partner needs care while the other wishes to remain in the home. While convenient and perhaps necessary, it will eat away at the equity you have in your home.

Investigate Reverse Mortgages

A reverse mortgage is sometimes a good solution for people who want to stay in their homes. An option for people over 62, a reverse mortgage is essentially a loan that you take out against the value of your home while you continue to live in it. The loan company will determine the value of your loan by assessing the value of your home, your equity, and your age. You then have access to the money via a lump sum, a line of credit, or monthly payments.

A reverse mortgage allows many people the option to hire in-home help while they live out their years in a home where they are comfortable. The downside for some is that they pay you in exchange for the value of your home, so there will be little or no value left to pass on to future generations.

Find a Real Estate Investor

The simplest solution to get the cash you need, with zero strings attached, is to sell your home for cash to a real estate investor. You won’t need to worry about paying back loans or navigating a reverse mortgage. Instead, you will have money in your pocket exactly when you need it. While you won’t necessarily get top dollar for your home, you are also relieved from the burden of repairs and upkeep and are guaranteed a simple transaction. By selling to an investor, you can hand your house over to someone who will take care of everything.

Navigating the financial challenges of your care can be overwhelming, but your home can be the financial security you need. Whether you choose to rent your home, obtain a bridge loan, investigate a reverse mortgage, or sell directly to a real estate investor, there are many methods to access the equity you’ve worked hard for in your home to fund your care. Each option has its own pros and cons. With careful consideration, you can choose the one that best suits your needs and circumstances, ensuring your golden years are financially secure and stress-free.

Video

Infographic

You can use your home’s value, regardless of its condition, to help pay for your care as you age. Consider working with home-buying companies or exploring creative funding options. Check out this infographic for more possibilities.