A flood can turn the most beautiful home into a complete wreck in minutes. Water damage, contamination, and potential mold are all serious problems no homeowner wants to face.

It’s common for homeowners to feel stuck after suffering flood damage. It can feel like the only option is to deal with extensive repairs to eliminate the damage when you’d rather sell and move on. And finding a buyer for a home in that condition feels impossible.

Do you have a flood-damaged house in Washington, D.C.? If so, you are likely dealing with repairs and insurance claims, and even worrying about a lower selling price.

You aren’t alone. Many homeowners in Washington, D.C., have faced similar obstacles after major storms, broken pipes, or flash floods. The good news is that even with flood damage, you can quickly sell your home and move on by understanding the necessary steps and making informed decisions.

Step 1: Assess the Extent of the Flood Damage

Before you can sell your home, you need a clear understanding of the extent of the flood damage. Even if the water has receded and the house appears dry, underlying problems like mold, weakened structures, and damaged electrical systems might still exist.

A professional inspector can provide an honest assessment of necessary repairs. An inspection also gives documentation you can use when negotiating with potential buyers.

In Washington, D.C., flood-prone areas like parts of Anacostia, Southwest Waterfront, and Bloomingdale have seen increasing concerns over property condition disclosures. Being transparent about your home’s condition is not just smart. It’s legally necessary.

Step 2: Weigh Your Repair Options

Once you know the full extent of the damage, you have two choices: 1) make repairs or 2) sell the home as-is. Repairs can be costly and time-consuming, especially if you need to remediate mold, replace drywall, or upgrade plumbing systems.

In some cases, investing in repairs might yield a higher sale price, but it may not be financially worth it in others. If you’re looking at tens of thousands of dollars in repairs just to bring the property back to livable standards, it may make more sense to market the home in its current condition to investors or cash buyers who specialize in restoration projects.

You must weigh repair costs against your timeline, financial resources, and goals for moving forward.

Step 3: Disclose Flood Damage Honestly

Selling a flood-damaged house in Washington, D.C., comes with disclosure responsibilities. Under D.C. law, sellers must disclose known material defects that could impact a buyer’s decision. Such defects include damage from past flooding, even if you made repairs.

Trying to hide flood history could expose you to legal risks later. Instead, use disclosure as a tool to build trust. Buyers who know the home’s history and feel they’re getting honest information will feel more confident moving forward.

If you repaired the damage professionally, share documentation like insurance claims, contractor receipts, and inspection reports to reassure potential buyers about the home’s condition.

Step 4: Decide How to Price Your Property

Expertly pricing a flood-damaged house is a very tricky part of the process. Pricing too high can scare off buyers. But too low results in a missed opportunity.

When setting your asking price, factor in the cost of necessary repairs, the stigma attached to flood history, and how your home compares to similar properties in your Washington, D.C., neighborhood.

It’s often smart to consult a real estate professional or appraiser who understands local flood risk patterns and how they affect property values. They can help you strike a balance that attracts serious buyers without drastically undercutting your potential earnings.

Step 5: Market to the Right Audience

Not every buyer is interested in a flood-damaged home, and that’s okay. The goal is to market your property to the right audience, not the widest one.

Cash buyers, real estate investors, and renovation specialists often seek homes that need significant repairs. They see potential where traditional buyers see problems.

You can save time and frustration by directly marketing to these groups. A quick Google search for “as-is home buyers near me” will help connect you with real estate professionals in your area who buy homes in any condition. These cash buyers can often close quickly, allowing you to move on without dragging out the selling process.

If you’re working with a real estate agent, ensure they have experience selling distressed properties. They’ll know how to highlight the property’s potential rather than its flaws.

Step 6: Consider Selling to a Cash Buyer

Selling a flood-damaged home in Washington, D.C., to a reputable cash buyer can be the most straightforward and financially sound solution. Cash buyers specialize in purchasing properties as-is, meaning you won’t have to spend time or money on repairs, inspections, or lengthy negotiations.

Imagine bypassing the stress of fixing waterlogged floors, battling mold remediation, and navigating endless buyer demands. With a cash offer, you can sell the home in its current condition and close the deal within days instead of months.

Cash home buyers in Washington, D.C., don’t rely on bank financing. As a result, you won’t face the uncertainty of a loan falling through at the last minute.

In a city like Washington, D.C., where property taxes, insurance, and maintenance costs can quickly add up, selling fast allows you to cut your losses and move forward with your next chapter.

Step 7: Prepare for Closing

Even with a cash sale, you still need to prepare for closing. Make sure you gather all necessary documentation, including:

- Proof of ownership (deed)

- Property disclosures (flood history, repairs, etc.)

- Any outstanding insurance claims or warranties

In Washington, D.C., closing on a property typically involves a title company or attorney. Choose a reputable professional who will ensure all paperwork is correct and help protect you legally throughout the process.

Fortunately, an experienced cash buyer often handles most of the closing details for you, making your end of the transaction even easier.

Selling a Flood-Damaged Home Doesn’t Have to Sink You

Flood damage got you feeling underwater? You can still sell your Washington, D.C., property for a fair price with the right approach. Being honest about the condition, marketing strategically, and targeting the right buyers, especially cash buyers, can turn a challenging situation into an opportunity.

Video

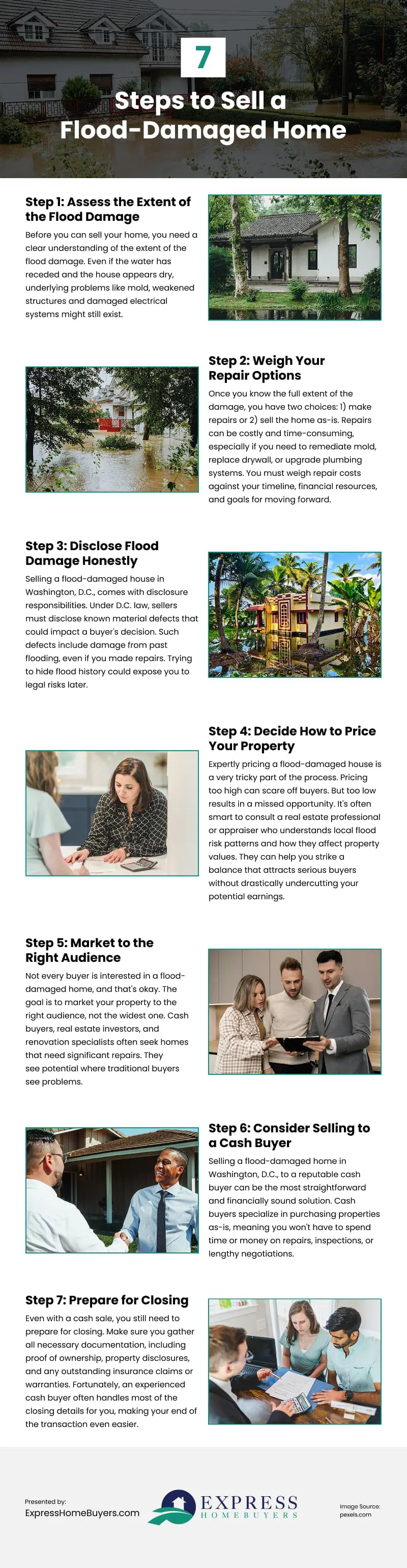

Infographic

If you’re dealing with a flood-damaged home in Washington, D.C., you may feel overwhelmed by repairs and insurance claims. However, you can still sell your home quickly by following the right steps. Check out this infographic for guidance on selling a flood-damaged property.