Receiving a home through an inheritance is a gift that can change the course of your financial future. Most people have the bulk of their wealth tied up in the value of their home, making this a generous and life-changing gift. Whether you decide to keep the house to live in, use it as an investment property, or sell it and pocket the cash, it is a complete game changer.

While inheriting a home will likely result in a nice boost to your net worth, it can be a complex process. Selling an inherited house can get complicated when splitting an inheritance with siblings.

Parents typically divide their estate equally between their children. As a result, those siblings will need to agree on some very personal and emotional decisions. Working through the sale of a family home with siblings can be taxing on even the strongest relationships.

Your parents will, and the estate laws in your local area have already created some rules to help keep the peace. Because inheritance laws vary significantly by location, you should consult your lawyer regarding your specific situation. If you are inheriting with siblings, here are the answers to five common questions to help on your journey:

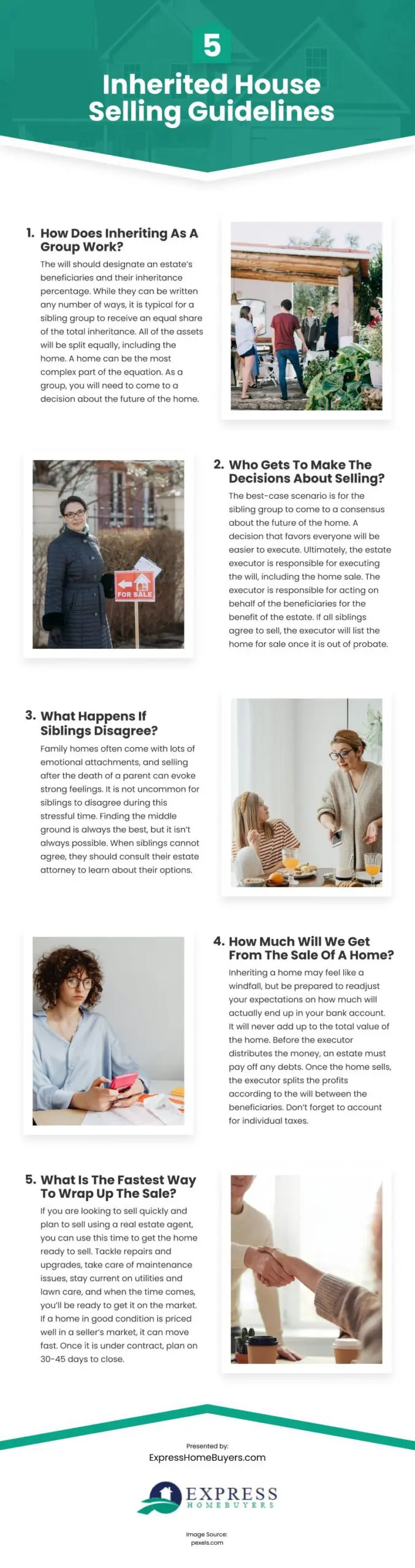

1. How Does Inheriting As A Group Work?

The will should designate an estate’s beneficiaries and their inheritance percentage. While they can be written any number of ways, it is typical for a sibling group to receive an equal share of the total inheritance. All of the assets will be split equally, including the home.

A home can be the most complex part of the equation. As a group, you will need to come to a decision about the future of the home. Typically, houses are sold, used as investment properties, or lived in by one of the siblings.

An ideal situation is for all parties to agree on how to proceed. Coming to an agreement that works for everyone will speed up the process, prevent lengthy legal proceedings, and help keep the peace.

2. Who Gets To Make The Decisions About Selling?

The best-case scenario is for the sibling group to come to a consensus about the future of the home. A decision that favors everyone will be easier to execute.

Ultimately, the estate executor is responsible for executing the will, including the home sale. The executor is responsible for acting on behalf of the beneficiaries for the benefit of the estate. If all siblings agree to sell, the executor will list the home for sale once it is out of probate. In certain circumstances, they can move forward with the sale of the home even if the siblings disagree.

3. What Happens If Siblings Disagree?

Family homes often come with lots of emotional attachments, and selling after the death of a parent can evoke strong feelings. It is not uncommon for siblings to disagree during this stressful time.

If a sibling wants to hold on to the home, they have the right to make an offer to the rest of the sibling group and buy out the other shares. Things get complicated when someone wants to keep the home but cannot buy the other shares. The law generally won’t compel people to continue ownership of a house they don’t want, so some siblings may feel forced to sell.

Finding the middle ground is always the best, but it isn’t always possible. When siblings cannot agree, they should consult their estate attorney to learn about their options.

4. How Much Will We Get From The Sale Of A Home?

Inheriting a home may feel like a windfall, but be prepared to readjust your expectations on how much will actually end up in your bank account. It will never add up to the total value of the home.

Before the executor distributes the money, an estate must pay off any debts. The proceeds from the sale of the home often pay off those debts. So subtract debts, mortgages, or liens from the home’s value. You will then need to pay for the work required to get the house ready to hit the market. Then, you should account for realtor fees and legal fees that may arise. Once the home sells, the executor splits the profits according to the will between the beneficiaries. Don’t forget to account for individual taxes.

A home is a valuable asset that can result in considerable money. But be prepared for the value of the check to be less than you first imagined.

5. What Is The Fastest Way To Wrap Up The Sale?

When someone passes away, their home will go into probate. Probate allows the legal team to establish the validity of the inheritance before anything permanent happens to the assets (like selling them).

If you are looking to sell quickly and plan to sell using a real estate agent, you can use this time to get the home ready to sell. Tackle repairs and upgrades, take care of maintenance issues, stay current on utilities and lawn care, and when the time comes, you’ll be ready to get it on the market. If a home in good condition is priced well in a seller’s market, it can move fast. Once it is under contract, plan on 30-45 days to close.

An alternative option often utilized by inheritance beneficiaries is selling to a real estate investor. You may not get a full-price offer by selling to an investor, but you will get a cash offer and a quick close. The investor will take care of all the repair items and update the home for today’s buyers. By selling to an investor, you can sell the house as-is for cash and wrap up the sale in as little as a week.

Selling with siblings isn’t easy. You can expect that you’ll likely disagree along the way. But with some mutual respect and understanding, you will make it to the other side of the real estate transaction with money in the bank and fond memories of the loved one who gave you such a generous gift.

Video

Infographic

Inheriting a home can be a life-changing financial event, especially when inherited alongside siblings. The process can be complex, involving legal, economic, and emotional considerations, but it’s a generous gift that can shape your financial future. Explore this infographic for valuable insights into inheriting and managing an inherited home with your siblings.